Getting My Offshore Trust Services To Work

Wiki Article

A Biased View of Offshore Trust Services

Table of ContentsThe Ultimate Guide To Offshore Trust ServicesMore About Offshore Trust ServicesHow Offshore Trust Services can Save You Time, Stress, and Money.Offshore Trust Services - The FactsThe Only Guide to Offshore Trust Services

Also if a creditor can bring a fraudulent transfer case, it is hard to prosper. They need to show past an affordable uncertainty that the transfer was made with the intent to rip off that specific financial institution which the transfer left the debtor financially troubled. Lots of overseas property defense plans entail even more than one lawful entity.

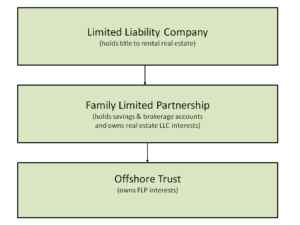

resident can develop an offshore trust and an U.S. restricted collaboration or an offshore limited liability business. Most overseas LLCs are created in Nevis, which for time has been a favored LLC territory. Nevertheless, recent changes to Nevis tax obligation and also declaring demands have brought about LLCs in the Chef Islands.

individual can develop a Nevis LLC and also transfer their company rate of interests and liquid assets to the LLC. The person might next establish a Chef Islands count on making use of an overseas trust fund firm as a trustee. The LLC concerns subscription rate of interests to the trustee of the Cook Islands trust. The Cook Islands trust would certainly have 100% of the Nevis LLC.

With this kind of offshore trust fund framework, the Nevis LLC is managed by the U.S. person when there are no expected suits. Once a lawful problem occurs, the trustee of the offshore trust fund must eliminate the U.S

Fund the count on by moving domestic properties to the offshore accounts. The very first action to creating an overseas count on is choosing a depend on territory.

The trustee firm will use software program to verify your identity and explore your present legal circumstance in the united state Depend on companies do not desire customers that may involve the business in investigations or lawsuits, such as conflicts including the U.S. government. You have to disclose pending litigation and also investigations as component of the background check.

Some Known Questions About Offshore Trust Services.

Lots of people pass the background check uncreative. Your residential property security attorney will collaborate with the offshore trustee firm to prepare the overseas trust contract. If you include other entities in the structure, such as a Nevis LLC, the lawyer will likewise compose the arrangements for those entities. The depend on contract can be customized based upon your possession protection and also estate preparation goals.

bookkeeping firms, and they supply the audit results and their insurance certificates to potential overseas depend on clients. Lots of people would like to keep control of their very own properties kept in their overseas trust fund by having the power to remove and also replace the trustee. Keeping the power to transform an offshore trustee produces legal threats.

A court might get the debtor to exercise their retained legal rights to substitute a financial institution agent for the current offshore trustee. Consequently, offshore count on asset protection works best if the trustmaker has no control over count on assets or various other celebrations to the trust. The trustmaker should not maintain any type of powers that they can be compelled to work out by an U.S

Not known Facts About Offshore Trust Services

Some trustee companies allow the trustmaker to reserve main discretion over trust investments and also account administration in the placement of trust expert. This arrangement gives the trustmaker some control over possessions conveyed to the trust, as well as the trustmaker can surrender civil liberties if they are threatened with lawsuit, leaving the offshore trustee in sole control.The trustmaker does not have straight access to overseas trust monetary accounts, but they can ask for circulations from the offshore trustee The possibility of turn over orders and also civil contempt charges is a considerable risk in offshore property defense. Debtors relying upon Full Article offshore trust funds ought to take into consideration the possibility of a domestic court order to restore possessions transferred to a borrower's offshore count on.

A court will not imprison like this someone for failing to do something that can not be done. In instances when a court orders a borrower to loosen up an overseas depend on plan, the borrower can assert that conformity is impossible since the depend on is under the control of an offshore trustee. But it's not as simple as invoking an unfeasibility defense and also saying, "I can't." Some current court choices treat a transfer of possessions to an offshore count on as a willful act of developing an unfeasibility.

The borrower had actually moved over $7 million to an overseas trustee. The trustee after that moved the exact same cash to an international LLC of which the debtor was the sole participant.

Unknown Facts About Offshore Trust Services

The overseas trustee refused, and also he claimed that the cash had been invested in the LLC (offshore trust services). The court held the borrower in contempt of court. The court discovered that in spite of the refusal by the overseas trustee, the borrower still had the capability to access the funds as the sole participant of the LLC.Report this wiki page